The future of private investing has just launched! I saw this on a LinkedIn post by my friend Daniel Gouldman.

I think this idea is really exciting because Republic is the private investing platform for investors seeking high growth potential. This means that anyone can invest!

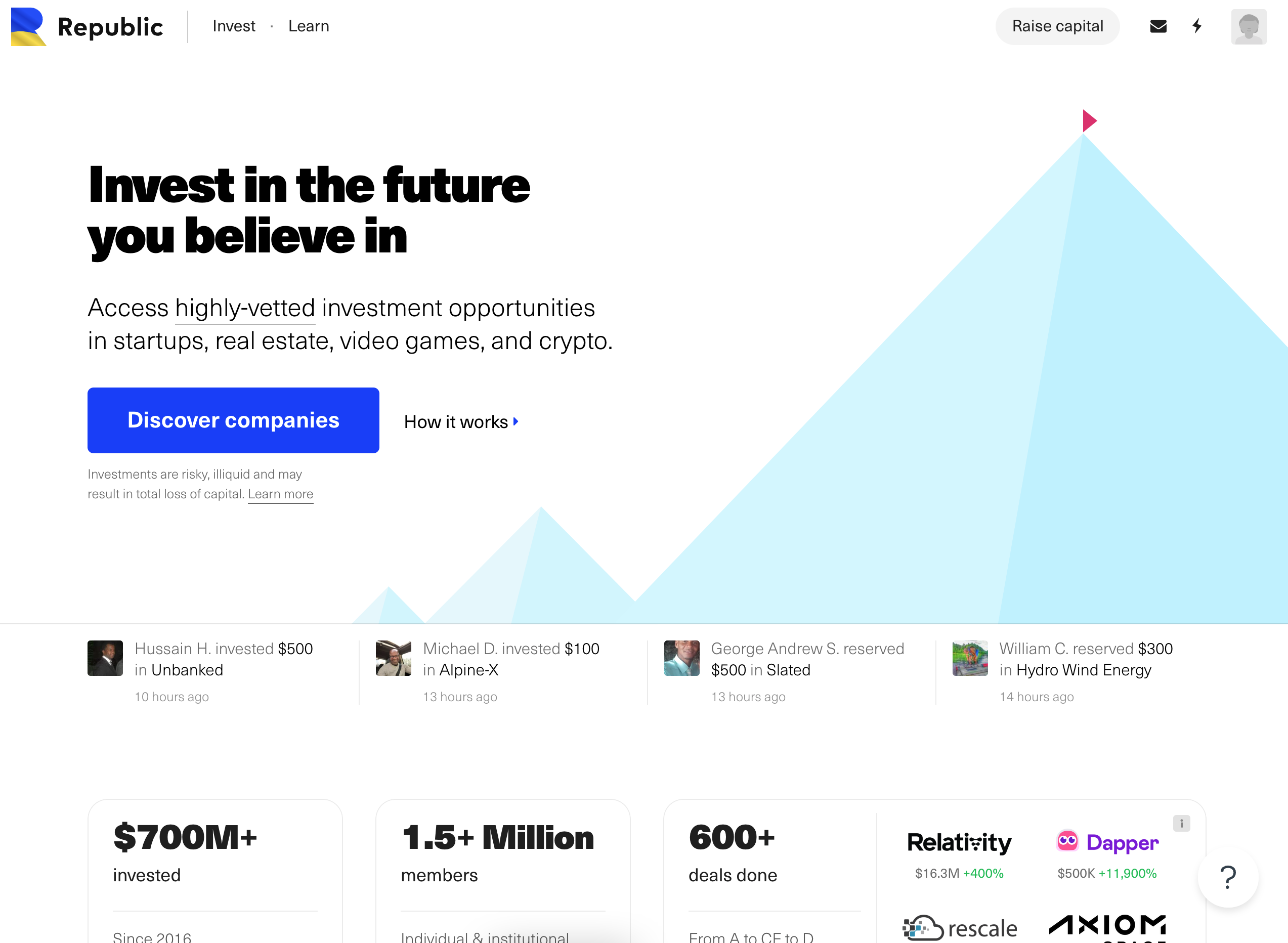

Republic curates private investing opportunities with high-growth potential across startups, gaming, real estate, and crypto.

Now there are growth opportunities for all sides of the investment market. Both accredited and non-accredited investors can meet entrepreneurs and access high-growth potential deals across a range of private markets.

For Individual investors

Republic’s success has been built off hundreds of sourced private deals, all available for investment from you with as little as $10 or as much as $107,000.

For Accredited investors

The benefits of the Republic platform, optimized for accredited investors, you'll have access a curated investor portal for unique private investment opportunities.

How it Works

Over the past 20 years, there has been a dramatic capital shift from the public to private markets. Since 2000, private market assets have grown 10x, representing over $6 trillion globally.* The private market, or investments outside of the stock market, were historically reserved for institutional and wealthy individuals. These include investments in private equity, private lending, real estate, venture capital, real assets such as artwork and even cryptocurrency.

While these asset classes make up a significant portion of a high net worth individual’s portfolio** access to these types of investments wasn’t available to the average individual due to regulations and the risks associated with private markets.

Thanks to Republic and the JOBS Act, anyone can become an investor in private markets and invest directly in highly-vetted startups, real estate, video games, local businesses, growth-stage companies, crypto, music, litigation finance and more. The Republic ecosystem has deployed over $800 million in investments, has supported over 600 companies, and boasts a community of over 1.5M users across 100 countries.

When you invest, you're investing in the success of founders, artists, entrepreneurs and creators. Republic made it their mission to expand access to innovative investments, empower individuals through education and give people the power to invest in the future they believe in.

When you invest through Republic’s ecosystem, you provide capital in exchange for a financial stake in a company, fund or project. That financial interest is bound by an agreement between you and the issuer, or a company, fund or project raising money. The official term for this agreement is a security. Securities can be offered under various registration exemptions such as Reg CF, Reg A+, Reg D and Reg S.

Below are the various types of investments on Republic and the relevant securities:

Equity

In startup investing, an individual can provide capital to a company in exchange for a piece of ownership in the company or what’s referred to as equity.

Future equity

This is a financial interest in the company that may provide the right to equity or a cash equivalency at a future time.

The security you receive is called the Crowd SAFE. SAFE is an acronym that stands for "Simple Agreement for Future Equity” and it does not mean it is a safe investment.

Digital assets

Digital assets are intangible assets that are created, issued, traded, and stored in a digital format. In the context of digital assets on a blockchain, digital assets include but are not limited to cryptocurrencies and crypto tokens. Digital assets may provide a return if the token is developed, delivered, and then gains value based on market demand or utility.

https://republic.com/