Bitcoin's spot trading volume is at its lowest level in six months.

Most cryptocurrencies traded lower on Tuesday as rising bond yields continued to weigh on U.S. equities. As investors reduce their appetite for risk, the most speculative areas of global markets have been hit the hardest.

For example, the Nasdaq 100 is down about 5% from its all-time high, compared with a 4% drawdown in the S&P 500 and a roughly 37% drawdown for BTC. Government bonds, deemed to be a traditional safe haven investment, are also selling off as yields rise. The iShares 20+ year Treasury bond exchange-traded fund (NASDAQ: TLT) is down nearly 17% from its recent high.

Still, despite the global market rout, bitcoin's spot trading volume is at its lowest level in six months. The "extended fearfulness, together with the recent low volatility, may have made traders hesitant to make moves," Arcane Research wrote in a report.

Derivative traders, however, have made some cautious moves recently. Leverage in the bitcoin futures market is skewed to the bearish side. That means short traders, or those positioned for continued price declines, could be forced to unwind their positions if BTC's price begins to rise. A rapid unwind could result in high volatility.

"The premier cryptocurrency is not growing because of the inaction on the part of retail and most importantly, institutional investors to stack up on the coin," Alexander Mamasidikov, co-founder of mobile digital bank MinePlex, wrote in an email to CoinDesk. Therefore, bitcoin's revival could depend on large investors returning at current or lower price levels despite macroeconomic headwinds.

Latest Prices

●Bitcoin (BTC): $41758, −0.94%

●Ether (ETH): $3122, −2.83%

●S&P 500 daily close: $4577, −1.83%

●Gold: $1814 per troy ounce, −0.14%

●Ten-year Treasury yield daily close: 1.86%

Bitcoin, ether and gold prices are taken at approximately 4pm New York time. Bitcoin is the CoinDesk Bitcoin Price Index (XBX); Ether is the CoinDesk Ether Price Index (ETX); Gold is the COMEX spot price. Information about CoinDesk Indices can be found at coindesk.com/indices.

Short-term accumulation

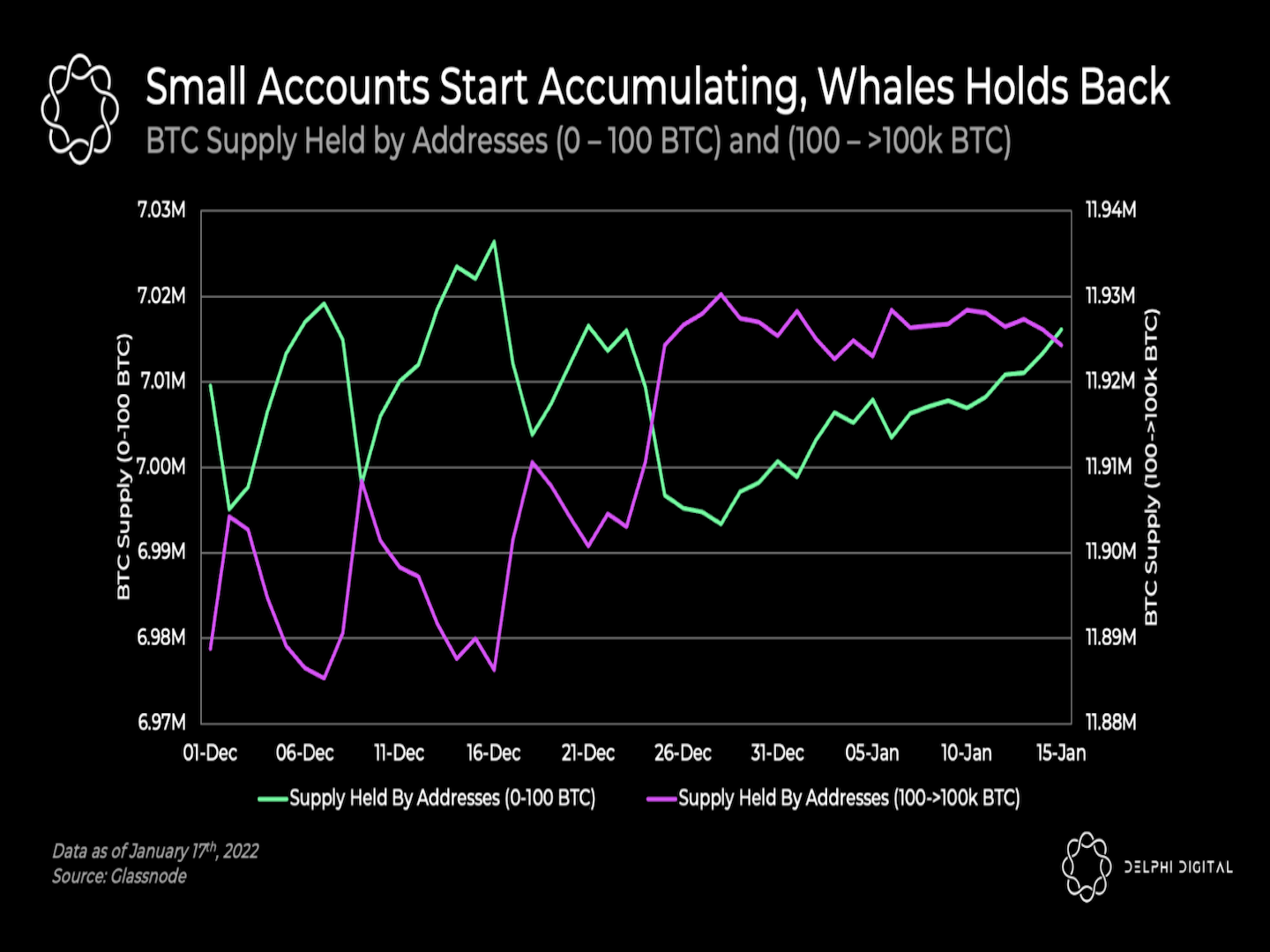

The chart below shows a rise in addresses holding 0-100 BTC over the past month, indicating an accumulation of bitcoin by small accounts. Large holders (addresses holding 100-100,000 BTC), however, remained on the sideline as the price of bitcoin continued to decline in December.

"It’s easy to see retail accumulation (small accounts) as a positive sign, as it means retail buyers are re-entering BTC," Delphi Digital, a crypto research firm, wrote in a blog post. However, "the lack of whales (large accounts) increasing their BTC holdings could suggest there’s more blood to come," Delphi Digital wrote.

Retail traders tend to sell quickly, which means the recent accumulation could be short-lived, especially if BTC fails to hold current price levels. Therefore, a sustained price increase will need stronger conviction by large bitcoin holders, similar to what occurred in previous bull runs.

Fund outflows continue

Investors pulled money out of cryptocurrency funds for a fifth straight week, reflecting the bearish market mood as bitcoin suffered one of its worst-ever starts to a year. Digital-asset investment products saw $73 million of outflows during the seven days through Jan. 14, according to a report published Monday by the crypto firm CoinShares.

Coindesk