Bitcoin continues to struggle below $42,000 as extreme fear grips the crypto market and analysts hint at a drop to $38,000.

The cryptocurrency market faced another day of weakness on Jan. 18 as the price of Bitcoin (BTC) dropped lower and additional pressure was also put on the altcoin market. Currently, the crypto Fear and Greed Index registered "Extreme Fear" among investors and some traders caution that BTC price could soon fall below its recent $39,000 swing low.

Data from Cointelegraph Markets Pro and TradingView shows that bulls lost control of the $42,000 support level during the early trading hours on Jan. 18 as bears hammered the BTC price to a daily low of $41,250.

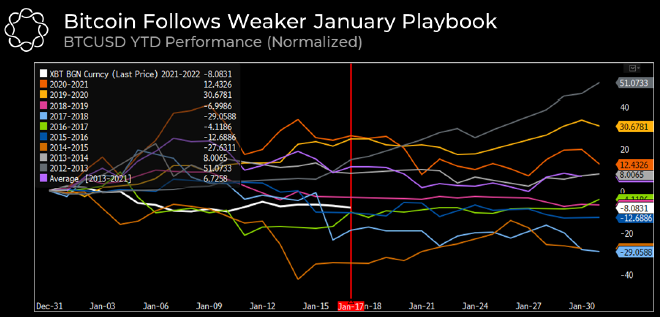

January is historically weak for Bitcoin

Many crypto holders who were disappointed by the lack of a blow-off top to close out 2021 are also expecting fireworks to start 2022, but historically speaking, January “has been one of the most disappointing months for BTC,” according to a recent report from Delphi Digital.

Delphi Digital pointed to “a slowdown in global liquidity growth and tighter policy expectations” as the primary source of headwinds for Bitcoin and they highlighted that these factors have also led to weakness in the stock market, which is considered to be strongly correlated with the price movements seen in BTC.

Another source of weakness identified by Delphi Digital was a lack of liquidity in the perpetual and futures markets along with a drop in BTC open interest over the past two months.

Delphi Digital said,

“For the most part, the price contraction stemmed from liquidity issues in the perp/futures market, which triggered a series of liquidations that exacerbated BTC’s initial price weakness.”

As for what comes next, Delphi Ditial indicated that “short-term momentum indicators appear to signal the worst may be behind us” and the analyst noted that the Fear & Greed index is at levels not seen since May 2021.

Bitcoin price could dip under $38,000

A similar trend of weakness was addressed by crypto market intelligence firm Decentrader, which observed that the number of overly bullish “I’m buying the dip” traders on crypto Twitter was challenged at around $41,000.

The analysts suggested that based on the size and consistency of the BTC drawdown over the past two months, “a move out of the range to the upside is the most probable outcome eventually and they expect the price “to run towards the 200DMA and the point of breakdown in the summer at around $49,000 – $50,000.”

Decentrader said,

“It is our view that we may need to see some further ranging between $44,000 and potentially $38,000 before an eventual breakout.” For traders hard hit by this latest drawdown, Twitter user John Wick issued a positive perspective.

The overall cryptocurrency market cap now stands at $1.976 trillion and Bitcoin’s dominance rate is 40%.

Cointelegraph