In investing, the trend is your friend – until it isn't. That proved true for digital currencies last year, and it could very well define the outlook for the best cryptocurrencies of 2022.

Overall, digital currencies produced a remarkable 2021 that helped solidify an already strong argument for their inclusion in more risk-tolerant investors' portfolios. Collectively, this asset class started 2021 with a combined market capitalization of just over $800 billion; by the time 2022 rolled around, that figure nearly tripled, to $2.25 trillion.

Not bad for an asset class that got its start just 13 years ago. And certainly more robust than the S&P 500's 29% growth (with dividends included!) last year. But cryptocurrencies didn't enter 2022 with a head of steam. Despite a heady performance across the whole of 2021, most major cryptos stalled toward year's end. Like stocks, most showed vulnerability to cyclical swings and changes in sentiment, especially as inflation became a prominent market driver.

To get a sense of whether digital coins might regain their momentum, we spoke to crypto experts to gather their thoughts about the coming year. That includes their opinions on the best cryptocurrencies of 2022 based on business cases and fundamentals. (Spoiler alert: No meme coins made this list.)

Let's start by quickly reviewing a few of 2021's cryptocurrency highlights, then we'll dig into the 2022 outlook for digital coins.

How Cryptocurrencies Fared in 2021

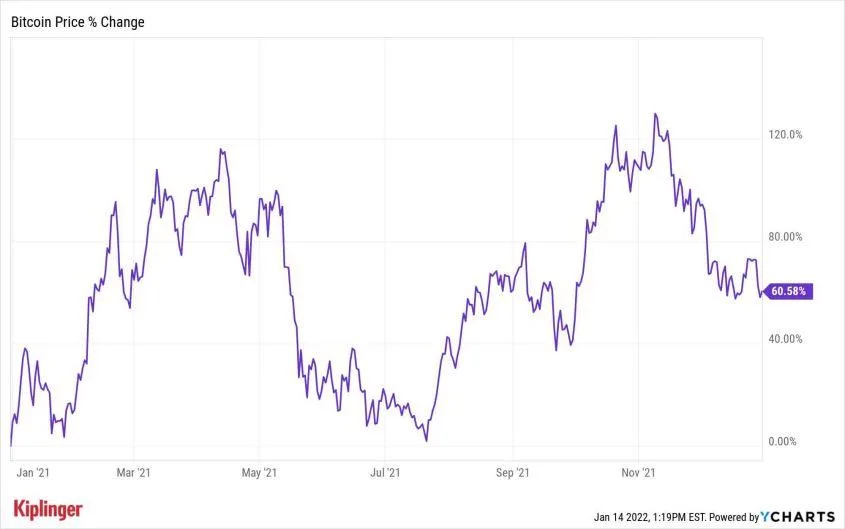

Despite bitcoin being a major standout in 2020, 2021 served as the Year of the Altcoin. Bitcoin climbed plenty by year's end, from a little more than $29,000 to around $46,000. That's a roughly 60% return, though it didn't happen in a straight line. The cryptocurrency rocketed to above $63,000 by April, plunged to below $30,000 in mid-July and crested just shy of $69,000 in early November before cooling off into year-end.

But Bitcoin wasn't even close to being one of the best cryptocurrencies in 2021

In fact, Bitcoin's dominance over the asset class shrank considerably during the year. Of the total market capitalization of the collective crypto market, Bitcoin accounted for 70% on Jan. 1, 2021, and by Dec. 31, that figure had dropped by 40%. Sure, Bitcoin did well … but its smaller share of the market means "altcoins" (other cryptocurrencies that aren't Bitcoin) performed much, much better.

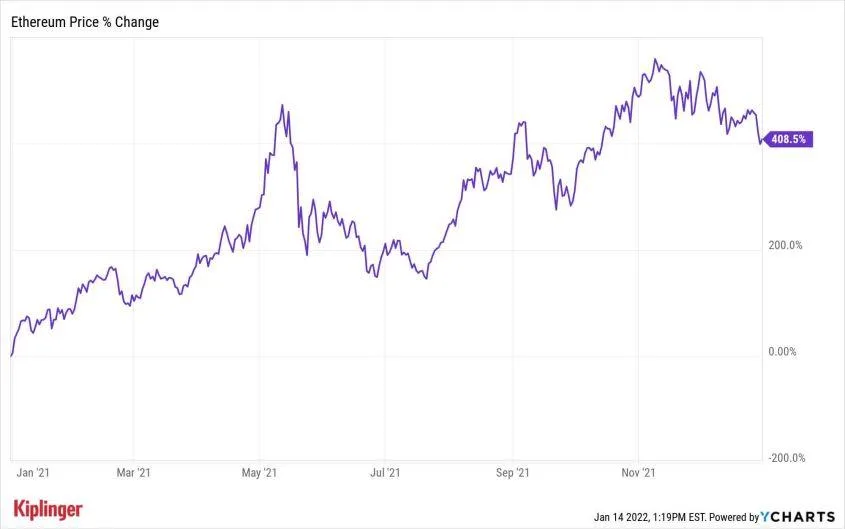

One such crypto is Ethereum, the world's second-largest cryptocurrency by market cap. The coin started 2021 under $740 and ended above $3,710 – roughly a quintupling in just a year! And that year-end figure represents a pullback from its November all-time highs around $4,891, when the cryptocurrency's market cap eclipsed half a trillion dollars.

The third biggest crypto by market cap, Binance Coin, started under $40 and rocketed 1,280% higher to end just shy of $530 – good for a $90 billion market capitalization. Another coin, Solana, finished an astonishing 9,600% higher to finish at a little over $55 million in market cap. Together, these coins now account for 6% of the overall crypto market.

Needless to say, cryptocurrency investors understandably have sky-high expectations. Those expectations that might not be realistic for many established coins – though some pros prefer the larger coins nonetheless.

With the backdrop set, let's look ahead to a few experts' thoughts on the best cryptocurrencies for 2022.

Coins With Fast Transaction Speed, Low Costs (Solana, Polygon, HBAR)

Kevin O'Leary, a strategic investor through Immutable Holdings, a blockchain holding company and panelist on CNBC's Shark Tank, examines coins through a software investor lens.

"[Rather than weigh the pros] and cons of each coin, I dig deeper into the developers, the team behind the blockchain, etc."

SEE MORE The 22 Best Stocks to Buy for 2022

O'Leary holds high conviction for Solana, Polygon and HBAR because he views the three coins with confidence that they "will continue to grow and develop steadily over the next year based on what I've seen from their development."

A quick look at each:

Solana: This coin launched in April 2019 as a project focused on blockchain's permissionless nature to provide decentralized finance (DeFi) solutions such as payment processing, smart contracts, stablecoins, peer-to-peer lending services and more. This project looks to facilitate decentralized app creation (DApp) and uses a hybrid method of validating transactions through a combined proof-of-history (PoH) and proof-of-stake (PoS) model.

Polygon: This platform looks to address many of the issues facing the Ethereum blockchain while still providing DeFi solutions. Namely, the platform looks to create "Ethereum's internet of blockchains" by connecting Ethereum-compatible blockchain networks and aggregating scalable solutions on Ethereum.

HBAR: Hedera, also known as HBAR, is the most-used enterprise-grade public network that powers the decentralized economy. HBAR's owners represent some of the world's leading organizations, including Alphabet (GOOGL), Deutsche Telekom (DTEGY), LG and TATA Communications. HBAR offers a blockchain for developers to create secure applications for enterprise needs.

O'Leary looks for features he believes distinguish coins from others. In particular, "both Solana and Polygon are exemplary in terms of their transaction speed in the forex market. There's a lot of possibility there in terms of financial transactions. Utility, and not just performance, should be taken into account when looking at cryptocurrencies."

These three coins could be among the best cryptocurrencies in 2022. Though O'Leary believes the broader crypto market will also continue its upward trend into the new year.

"I expect the momentum [from 2021] to explode," he says.

O'Leary does see challenges ahead, of course. Among them: Some governments, including China and much of the Middle East, have enacted crypto bans. But O'Leary doesn't see this solving any problems; instead, he believes better regulation is needed.

"Regulation is key to the future growth of the market, at least in the U.S. Some investors will not feel comfortable until there's clearer guidance from the SEC and others on exactly how cryptocurrencies are to be regulated and taxed."

NFTs

O'Leary adds that "between the popularity of certain coins and the interest in NFTs, we're looking at a potentially groundbreaking 2022." NFTs, or non-fungible tokens, are one-of-a-kind (so, non-fungible), identifiable digital assets (tokens) that exist as part of the Ethereum blockchain, though other blockchains have begun to support their own versions of this unique asset class. NFTs can represent anything digital – sports cards, music, memes – though much of the hype surrounding them comes from their use as digital art.

People have treated NFTs as you would collecting fine art: Anyone can buy a Picasso print, but only one person can own the original. NFTs have grown by leaps and bounds. NFT statistics show a market in full bloom, swelling to more than $20 billion globally in 2021.

DAOs, Social Tokens (MakerDAO, AAVE, Curve DAO)

Jordan Fried, CEO and founder of Immutable Holdings, thinks "2022 is the year of DAOs, social tokens and innovation in NFTs."

A DAO, or decentralized autonomous organization, is actually an online community that jointly controls a cryptocurrency wallet, typically with a token based in the Ethereum ecosystem. It works toward some common mission, such as running a business or making investments. Rules are encoded as a computer program, which controls how the organizations' members engage with each other; those rules, as well as transaction records, appear on a blockchain.

Individuals can buy DAO tokens to become a member of the community. They have prices and are measured in market capitalizations, just like other cryptos. But they usually can't quite be spent like you would Bitcoin, Ethereum or other cryptos.

Fried thinks 2022 will continue to see DAO-based projects thrive because "they fundamentally disrupt the way organizations operate. [DAOs allow] participants in an organization to have skin in the game and really participate in decision-making."

He also believes 2022 will see a rise in "social tokens" (also issued through DAOs), which allow artists, brands and other entities to monetize themselves.

"I think we're going to see an increasing number of social clubs, fan bases, artists and even companies convert into DAOs, and I think these are going to be some of the most exciting projects to be part of in the coming years," he says.

Digital Gold (Bitcoin)

Views on cryptocurrency run the gamut, from "Ponzi scheme" to "future of payment facilitation and economic equalizer." One major thesis promoted by many comes from the view that Bitcoin may serve as a "digital gold," providing protection from rising inflation the world economy currently sees to a concerning degree.

Wealth services firm Wilmington Trust says in a white paper that Bitcoin serves a role as "digital gold," though it "would not be as a true equivalent, as it has no physical asset of value backing it, but more as a currency hedge against the U.S. dollar losing its coveted status as world reserve currency."

The bank reasons that the original crypto has witnessed a 237% annualized return since 2010 but has come with a "standard deviation four to six times that of stocks and three drawdowns (peak-to-trough asset losses) of between 53% and 83% in the last four years alone."

These outsized returns (and risk) make it a suitable investment in small portfolio allocations, especially for those looking to capture an alternative investment opportunity capable of producing huge returns and also hedging against the threat of rising inflation eroding the spending power of fiat currencies.

On the latter point, Wilmington believes "cryptocurrencies could supplant traditional gold as the typical investment store of value, and the past year of comparative returns would suggest this may already be taking place."

Wilmington Trust isn't alone in this belief. A survey from JPMorgan shows 67% of millennials confess to seeing Bitcoin as the new gold as well. Respondents to the survey said they'd prefer Bitcoin to gold as a way to weather volatile financial markets.

The Best Cryptocurrency(ies) for 2022?

As with any forecast, you go in knowing it's inherently flawed. The above thoughts highlight some growing areas of the crypto universe not yet seen by the masses. Will they indeed prosper into market leading cryptos, further eroding Bitcoin's market dominance?

If current trends remain intact, big names such as Bitcoin and Ethereum could indeed dither while smaller players steal away market share. The crypto space has already seen an influx of smaller altcoins offering greater functionality and utility than digital "blue chips." Many coins came to be as a result of faults or shortcomings of the major coins driving awareness for the space.

But remember: The cryptocurrency market isn't a zero-sum game. For smaller altcoins to prosper, neither Bitcoin nor Ethereum need to tumble.

Larger coins' sheer size diminish their ability to deliver outsized returns – the Law of Large Numbers prevents such growth, leaving the greatest headroom to smaller, more nascent opportunities targeting niche applications.

However, blue-chip coins such as Bitcoin or Ethereum may be the best cryptocurrencies for investors seeking relatively safer investments for the long-term, just given their current market position and built-in network of applications. Thus, they shouldn't be dismissed. Bitcoin specifically remains the single greatest store of value in the crypto universe in terms of market capitalization and name cachet.

Further, it leads in use cases around the world, offering the most physical locations for use through network points like Bitcoin ATMs alongside the broadest level of acceptance for making payments online. Payment processors such as PayPal (PYPL) even allow their users to transact in the digital currency, while Fortune 500 companies accept it as a valid form of payment.

Bitcoin's trailblazing has opened the doors for many coins to follow. These smaller coins have roles to play; together, this asset class is poised to continue shining well into 2022 and beyond.

Finance.Yahoo