Bitcoin leaps over $49,000, while ether and other altcoins also rise.

Market moves: Bitcoin jumps above $49,000 after U.S. Fed’s decision to accelerate stimulus withdrawal.

Technician’s take: Bitcoin’s price momentum is stabilizing after several weeks of low trading volume.

Markets

S&P 500: $4,709 +1.6%

Dow Jones Industrial Average: $35,927 +1.1%

Nasdaq: $15,565 +2.1%

Market moves

Bitcoin, the No. 1 cryptocurrency by market capitalization, jumped above $49,000 on Wednesday, after U.S. Federal Reserve officials approved the acceleration of the central bank’s plan to withdraw coronavirus pandemic stimulus efforts.

Following the news, crypto and traditional markets turned higher as the central bank’s decision diminished investor uncertainty. The Fed bankers signaled they are ready to raise the short-term interest rate at least three times next year to battle the current high inflation.

The whole crypto market was watching the Fed decision closely because many believe tightened monetary policy is typically considered bearish for risk assets, crypto included. Prices for bitcoin and other crypto fell sharply in recent weeks because investors were worried about the Fed’s anticipated hawkish policy adjustment. The price rise after Wednesday’s news showed “a relief rally,” as CoinDesk reported.

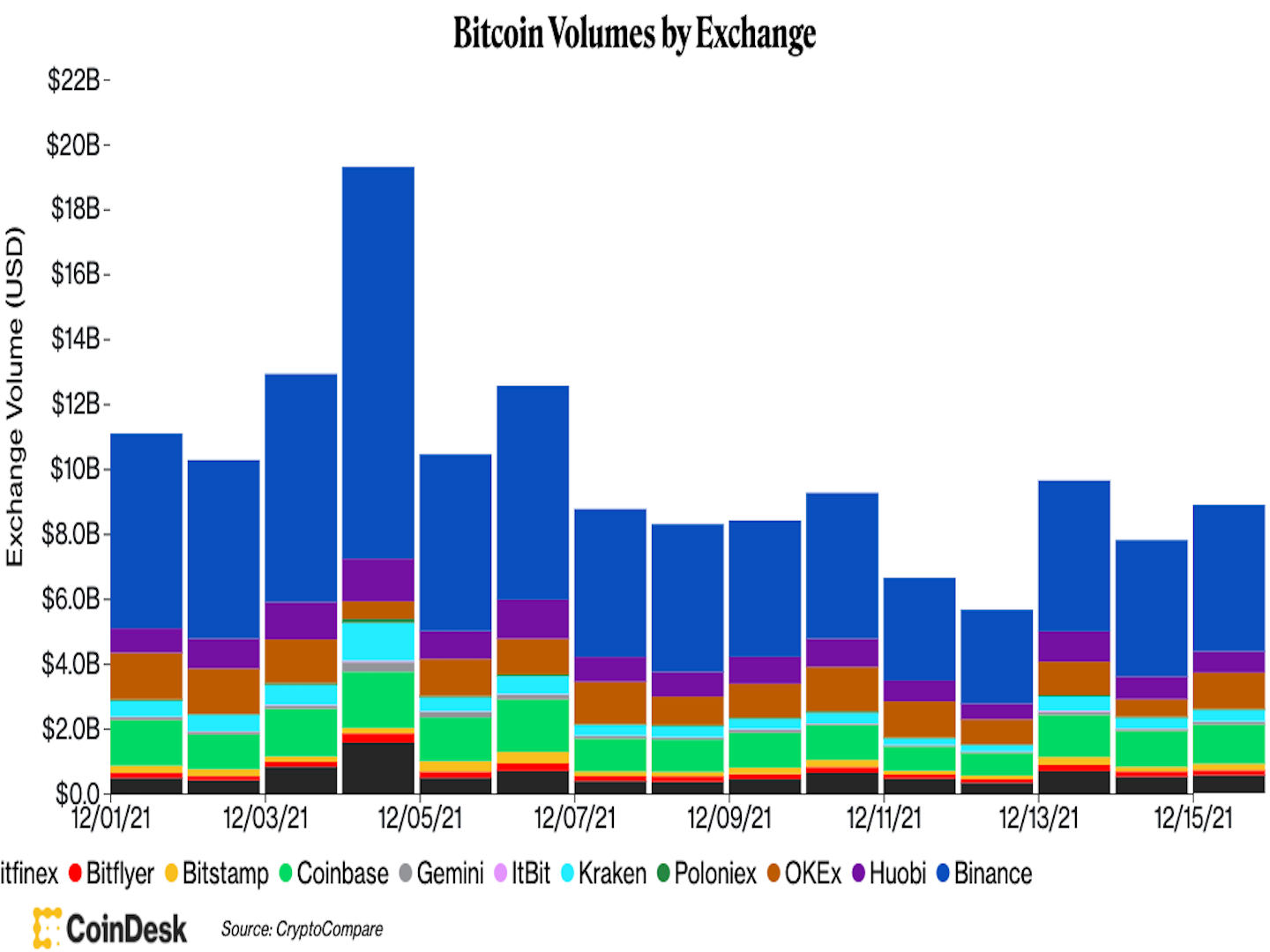

Bitcoin’s trading volume across major centralized exchanges was slightly higher on Wednesday compared with a day ago. Prices for other major cryptocurrencies also rose. Ether went above $4,000 after it slipped below $3,700 earlier this week.

Bitcoin (BTC) held support around $46,000 and is attempting to reverse a short-term downtrend. Still, upside appears to be limited toward the $52,000 resistance level, which is roughly midway through the 20% sell-off that occurred earlier this month.

The relative strength index (RSI) on the daily chart is the most oversold since May 20, which preceded a strong price recovery. Momentum is also stabilizing after several weeks of low trading volume.

On the weekly chart, price conditions are less favorable as the uptrend appears to be slowing. For now, this suggests short-term buyers could struggle beyond $50,000-$55,000.

Coindesk