During last week’s snoozer of a congressional hearing on the $2.5 trillion crypto-blockchain business, we got just a small glimpse into just how little the government knows about a technology that could transform the way we do business.

A more complete picture of this utter fecklessness is playing out in federal court in lower Manhattan in a case titled Securities and Exchange Commission v. Ripple Labs.

It will likely determine how much regulation there will be over the burgeoning crypto industry, and at least so far, the SEC is demonstrating why it should be nowhere near policing something reasonably described as the next Internet.

The SEC case hinges on some allegedly bad stuff done by Ripple. The SEC says Ripple execs sold an unregistered cryptocurrency called XRP to get rich and finance the build-out of its blockchain-like platform that transacts cross-border payments. The SEC says the XRP sales were no different from a company selling a stock or bond, and were illegal because they weren’t registered with the commission.

Ripple counters that the SEC is creating a legal double standard. The XRP sales were legal because XRP is not that much different from other non-registered cryptos, industry heavyweights such as Ether and Bitcoin.

If the creators of the first blockchain did not have to register their sales of Bitcoin, why should Ripple? Ditto for the dudes who created Ethereum.

The SEC seemed to officially declare Bitcoin and Ethereum’s Ether a compliant crypto in a 2018 speech by Bill Hinman, the former head of the SEC Corporation Finance Division. Ripple’s defense hinges in part on using Hinman’s words against the commission; XRP was used in the same way the Ethereum people used Ether to finance the initial build-out of their platform. So what’s the beef?

This is where things get nonsensical on the part of the SEC. The commission is now arguing that whatever Hinman said, his speech meant nothing. It’s simply his opinion, nothing more. In court, the SEC is telling the crypto world it really hasn’t made an official ruling whether Bitcoin or Ethereum’s Ether comport with securities laws.

“I don’t want to be overly technical but … there is no action that [the SEC] took to say Bitcoin is not a security, Ether is not a security,” the SEC’s lawyer said.

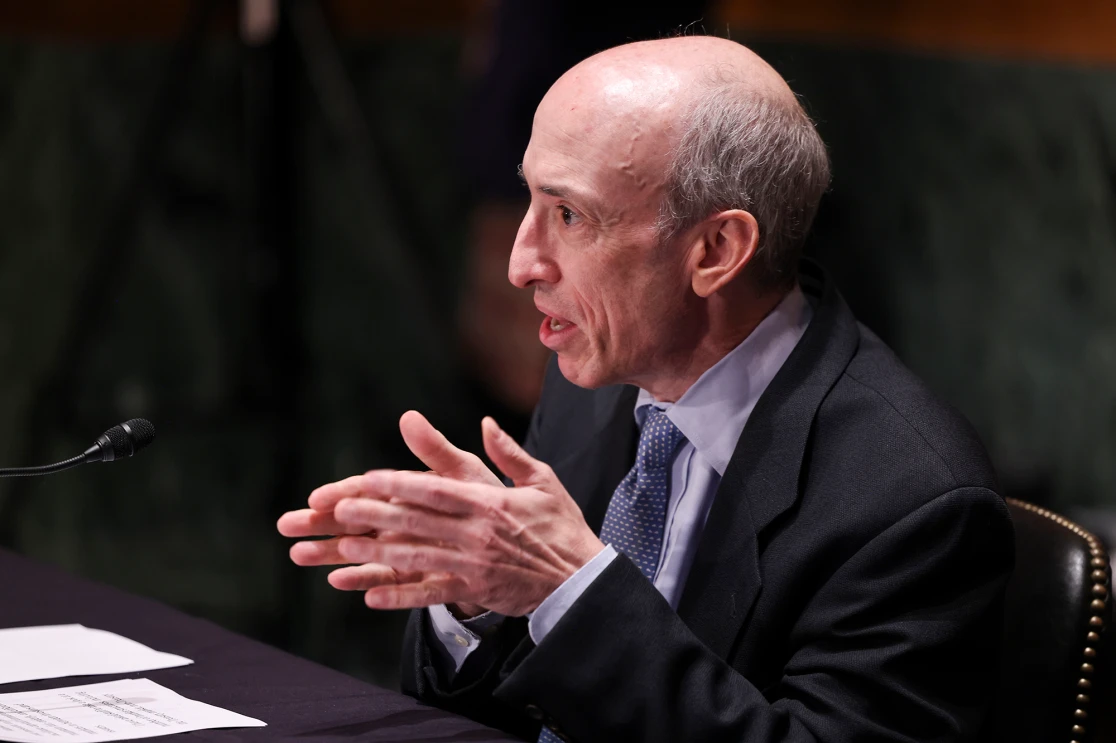

So the words of a top official — reviewed by then-SEC Chair Jay Clayton — doesn’t reflect commission policy? Does that really mean SEC chair Gary Gensler is going to track down the elusive Satoshi Nakamoto (whoever he or she is) to do to Bitcoin what he’s doing with Ripple?

The SEC declined to comment.

Big Media vs. Gigi

The popular explanation for Gigi Sohn’s imploding nomination as an FCC commissioner is ideological: Sohn — a progressive firebrand — is the victim of the fiercely partisan debate over who gets to regulate the $22 trillion US economy.

Yes, there is a lot of that at play following the Senate Commerce Committee’s move to put off a vote on Sohn’s nomination until probably next year, and possibly forever. But the Sohn imbroglio is more than a right vs. left fight; it pits a key part of the Democratic donor base against the party’s progressive wing.

While Sohn is at odds with conservatives and their allies in the Senate, she’s no darling of Big Media, which has a direct line into the party’s ruling elite involving the FCC: Senate Majority Leader Chuck Schumer, Senate Commerce Committee Chair Maria Cantwell, and of course House Speaker Nancy Pelosi.

You see, as much as the media and Hollywood types love to sound woke, their virtue signaling has limits when money is on the line. Sohn has a long record questioning two issues they hold near and dear to their bottom lines: Overly restrictive copyright protections and something called “retransmission consent.”

Copyright protections are easy to grasp. Media companies own the stuff they create and copyright. If you pirate the content, you have to pay. The concept of retransmission consent is a little more complex but it leads to the same place: Money and lots of it.

In the old days, cable operators could take a local network’s signal and air it without a second thought. Congress put an end to that in 1992, so now cable operators must cut deals seeking “retransmission consent” with Big Media companies to air their local network programming.

Sohn has a long record stating that both issues grant too much power to Big Media at the expense of consumers. She has advocated the FCC put a limit on how much networks and their powerful parents, i.e. ABC (Disney), NBC (Comcast), CBS (ViacomCBS) and Fox (my employer) can squeeze from these lucrative revenue sources.

The broadcast networks through their lobbying group, the National Association of Broadcasters, put Schumer & Co. on notice that the Sohn nomination as of now is a no-go without some conditions, sources tell me. That’s one reason it has been postponed so Cantwell can work on a plan to save it possibly by having Sohn recuse herself from those two issues when they come up for an FCC vote.

NYPOST