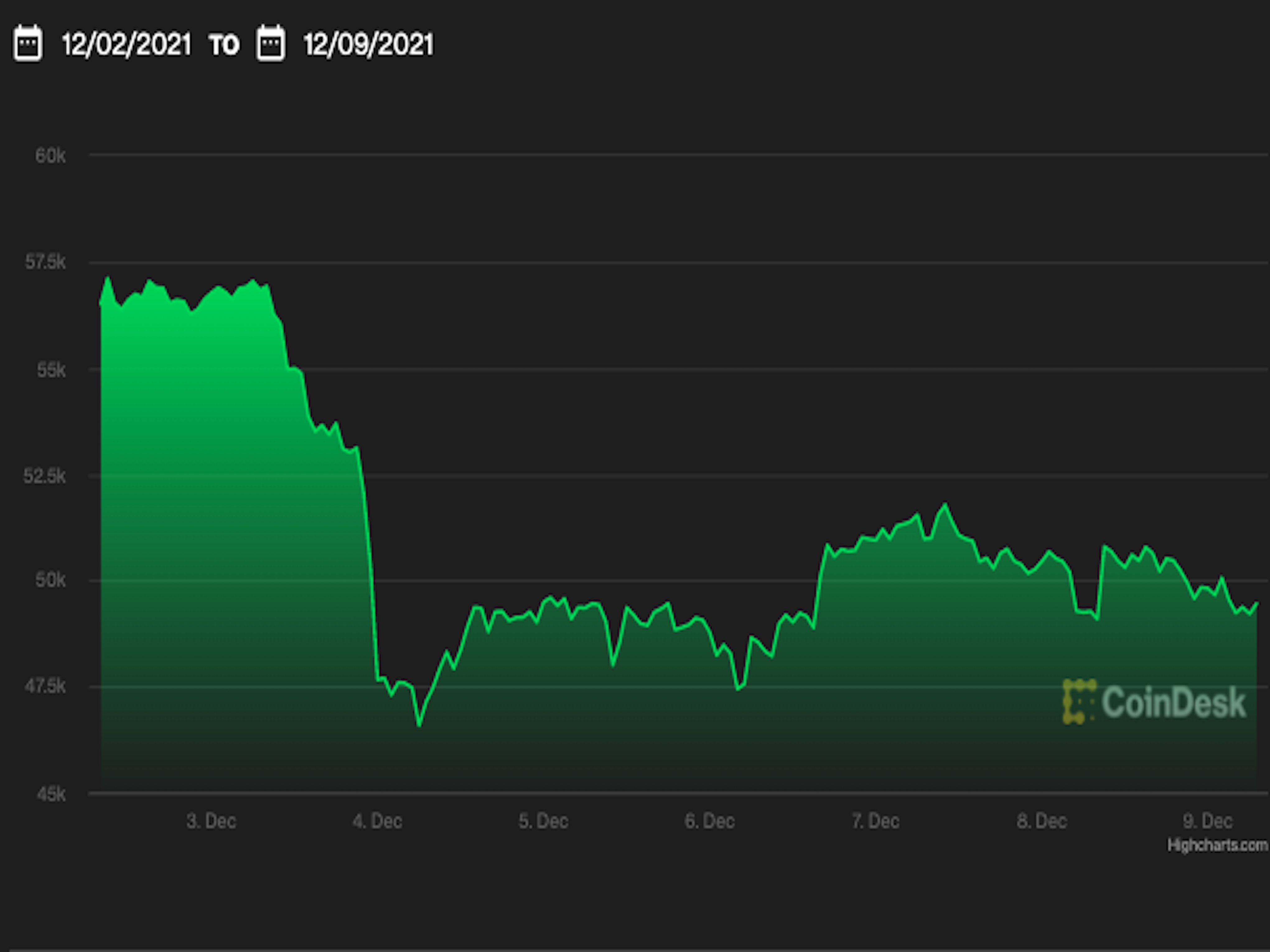

Bitcoin’s price popped briefly above $50,000 after Wednesday’s congressional hearing in Washington, but the momentum has faded.

Bitcoin failed to hold above the $50,000 mark and was down 4.2% over the past 24 hours. The largest cryptocurrency by market cap was looking weak on Thursday, a day after executives from six major crypto firms spoke before the U.S. Congress’ Financial Services Committee.

The hearing, which clocked in as one of the longest congressional hearings ever on crypto, lasted almost five hours. Nearly 40 lawmakers asked questions ranging from specific topics like stablecoin backing to broader areas like use cases in the crypto sector.

Bitcoin and Ethereum saw significant bids being stacked up following the hearing. However, that has since slowed down according to Matthew Dibb, Stack Funds’ chief operating officer.

Ether price

Ether (ETH), the second-largest cryptocurrency by market capitalization, was trading at around $4,191 at press time, down 5% over the past 24 hours. All eyes are on the ETH/BTC trading pair, according to Dibb. That’s the ratio between prices for ether and bitcoin, and it’s used to track the relative strength between the two cryptocurrencies.

The ratio rose even when the market crashed last weekend, rising by about 13% to reach a three and half-year high and register its best weekly performance since May.

Analysts pointed to several factors to explain the upward trajectory, one of them being the Ethereum blockchain’s EIP-1559 upgrade implemented in August. That change has effectively reduced the net new supply of ether from the Ethereum blockchain, and it appeared to help ETH/BTC make gains in a risk-off environment.

ETH/BTC ratio

“ETH/BTC is showing a huge amount of outperformance since the start of November,” Dibb said.

Dibb said if that trend continues, traders can expect the ETH/BTC ratio to hit 0.10 in the first quarter of 2022. The ratio is now at 0.8.

For altcoins, XRP was up 3% on the day, Terra’s LUNA by 0.19% and BNB was down 2.11%, according to data source Messari. In traditional markets, U.S. stock futures pointed to a lower open in New York, and European equities edged down as investors took into account new restrictions to battle the spread of the Omicron COVID-19 variant.

Coindesk