CEOs from six major crypto firms spoke before the U.S. House Financial Services Committee; stocks rose amid fading Omicron concerns.

Market moves: Bitcoin moved little as the market watched six crypto leaders testify before Congress

Technician’s take: Selling pressure could slow heading into the Asia trading day as indicators appear oversold.

Catch the latest episodes of CoinDesk TV for insightful interviews with crypto industry leaders and analysis.

Prices

Bitcoin (BTC): $50,676 +0.5%

Ether (ETH): $4,422 +3.33%

Markets

S&P 500: $4,701 +0.3%

Dow Jones Industrial Average: $35,754 +.09%

Nasdaq: $15,786 +0.6%

Gold: $1,783 -0.9%

Market moves

Bitcoin hovered at around $50,000 on Wednesday, as the crypto market closely observed the CEOs of six major crypto companies share their opinions on regulation with the U.S. House Financial Services Committee. Ether spent a good part of the day at over $4,400.

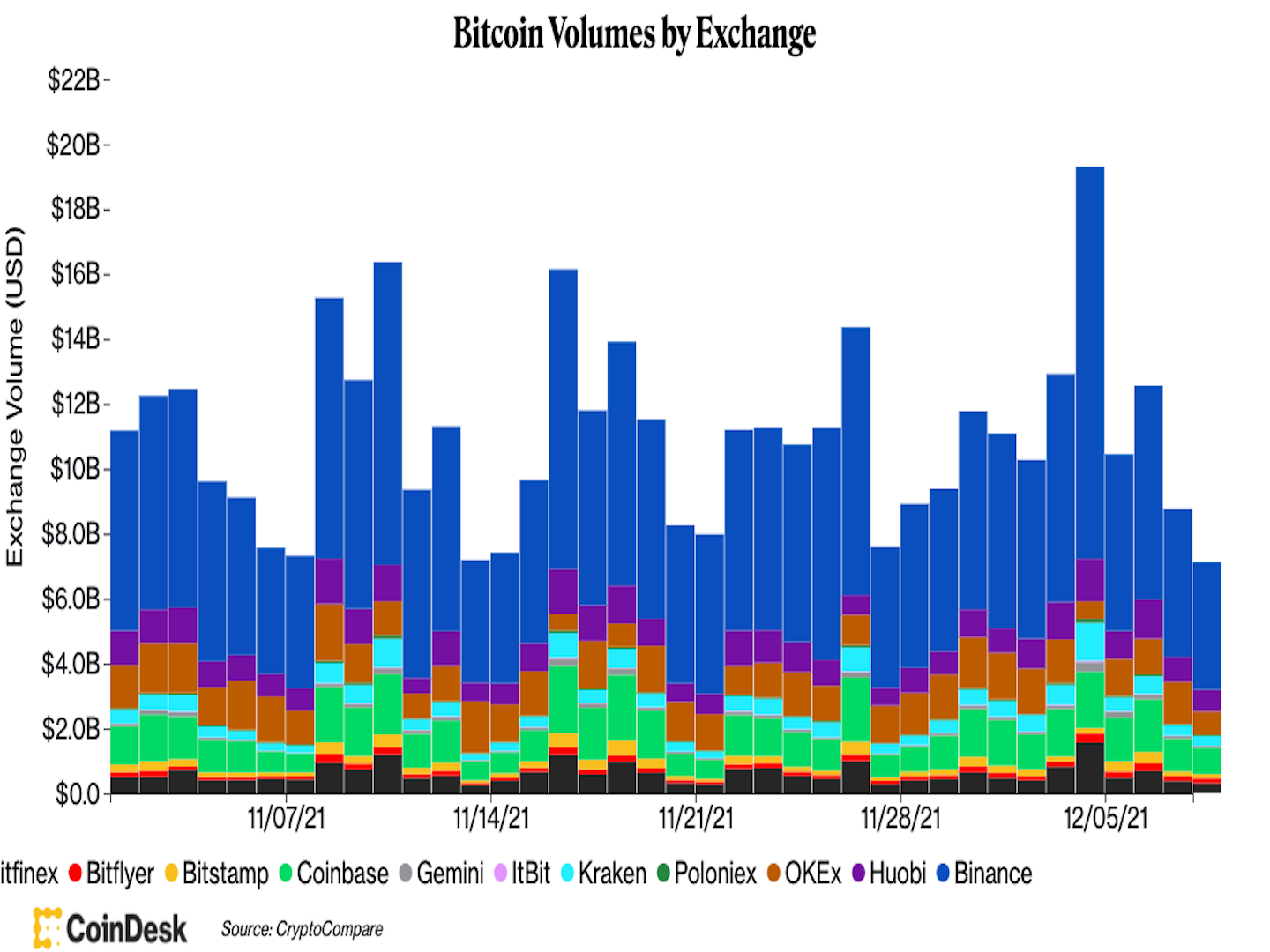

At the time of publication, bitcoin was changing hands at $50,676, up slightly over the past 24 hours, according to CoinDesk data. Trading volume on major centralized exchanges fell again on Wednesday.

Credit: CoinDesk/CryptoCompare

A good portion of the crypto world on Wednesday was focusing on the congressional hearing on digital currencies and stablecoins. Circle CEO Jeremy Allaire, FTX CEO Sam Bankman-Fried, Bitfury CEO Brian Brooks, Paxos CEO Charles Cascarilla, Stellar Development Foundation CEO Denelle Dixon and Coinbase CEO Alesia Haas (who is also chief financial officer of the Coinbase Global parent company) all testified. CoinDesk’s Nikhilesh De live blogged the hearing, and the full coverage can be found here.

Amid Cascarilla’s participation, stellar (XLM) prices rose by roughly 6% on Wednesday. The performance of XLM tokens hasn’t been impressive on a relative basis, up just about 98.6% over the past year versus ether’s 691% increase during the same time period.

Stocks rose on Wednesday again as fears about the Omicron coronavirus continued to fade. Investors’ rising appetite for risk assets came after Pfizer and BioNTech announced that initial lab studies showed a third dose of their COVID-19 vaccine could “neutralize” the new variant. That could potentially benefit the crypto market, as it usually follows the stock market.

Technician’s take

Bitcoin Range-Bound Above $46K Support, Resistance at $55K

Bitcoin four-hour price chart shows support/resistance (Damanick Dantes/CoinDesk, TradingView)

Bitcoin (BTC) continues to stabilize at about $50,000 after a near 20% sell-off over the past weekend.

For now, the cryptocurrency remains above $46,000 support, which could stabilize short-term pullbacks. Buyers will need to break above $55,000 resistance to yield further upside targets.

Momentum signals are improving on intraday charts, which suggests buyers could remain active at around current support levels. And the relative strength index (RSI) on the daily chart is the most oversold since late September, which preceded a price rally.

Bitcoin is stuck in a short-term downtrend, defined by lower price highs over the past month. Price indicators, however, suggest selling pressure could slow heading into the Asia trading day. That means intraday trading volume could rise around the 100-period moving average (currently around $54,500) on the four-hour chart.

Important events

9:30 a.m. HGT/SGT (1:30 a.m. UTC): China consumer price index (Nov. YoY/MoM)

9:30 a.m. HGT/SGT (1:30 a.m. UTC): China producer price index (Nov. YoY)

2 p.m. HGT/SGT (6 a.m. UTC): Japan machine tool orders

3 p.m. HGT/SGT (7 a.m. UTC): Germany imports/exports (Oct. MoM)

Puerto Rico Blockchain week (Dec. 6-12)

CoinDesk TV

In case you missed it, here are the most recent episodes of “First Mover” on CoinDesk TV:

Nexo Partners With Fidelity Digital Assets to Expand Institutional Access to Crypto, Crypto CEOs to Testify Before Lawmakers Weighing Greater Regulation

“First Mover” hosts spoke with Kalin Metodiev, co-founder and managing partner at Nexo, as the fintech formed a partnership with Fidelity Digital Assets to expand institutional access to crypto. MoonPay co-founder and CEO Ivan Soto-Wright provided insights into its latest funding round that values the company at $3 billion. Crypto CEOs are testifying in front of lawmakers today. CoinDesk’s managing editor for global policy and regulation, Nikhilesh De, brought us the latest from the hearing. Plus, CoinDesk Chief Insights columnist David Z. Morris spoke with one of CoinDesk’s Most Influential winners, Strike CEO Jack Mallers.

Latest headlines

Crypto VC Chiron Raises $50M to Invest in Terra Ecosystem as LUNA Stays Hot: The fund is the latest cash influx into decentralized finance (DeFi) and Web 3 gaming projects from institutional investors.

Australia Set for Massive Shakeup to Crypto Regulations: Treasurer: The country will launch its biggest payments reform in 25 years, its treasurer said in an interview.

Gibraltar to Integrate Blockchain Into Government Systems: The pilot project is being undertaken with the support of Latin American crypto exchange Bitso and RSK blockchain developer IOVlabs.

Sushi CTO Joseph Delong Resigns After Reports of Project Infighting: The technical lead for one of DeFi’s most prominent protocols is out after weeks of controversy and a 50% drop in the price of SUSHI over the last month.

Most Influential 40: Isaiah Jackson: The “Bitcoin & Black America” author continues to inspire.

Longer reads

Most Influential: The Developers Who Wrote Bitcoin’s Taproot Upgrade: With Taproot, Bitcoin has gained a valuable set of tools for developers to integrate new features that will improve privacy, scalability and security.

Today’s crypto explainer: What Is a Bitcoin ETF?

Other voices: A Bitcoin Boom Fueled by Cheap Power, Empty Plants and Few Rules (The New York Times)

DISCLOSURE

The leader in news and information on cryptocurrency, digital assets and the future of money, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a strict set of editorial policies. CoinDesk is an independent operating subsidiary of Digital Currency Group, which invests in cryptocurrencies and blockchain startups.

Muyao Shen

Muyao is a reporter on the markets team. She is based in Brooklyn, New York. She owns a marginal amount of bitcoin.

Follow @MuyaoShen on Twitter

Damanick is a crypto market analyst at CoinDesk where he writes the daily Market Wrap and provides technical analysis. He is a Chartered Market Technician designation holder and member of the CMT Association. Damanick is also a portfolio manager at Cannon Advisors, which does not invest in digital assets. Damanick does not own cryptocurrencies.

A good portion of the crypto world on Wednesday was focusing on the congressional hearing on digital currencies and stablecoins. Circle CEO Jeremy Allaire, FTX CEO Sam Bankman-Fried, Bitfury CEO Brian Brooks, Paxos CEO Charles Cascarilla, Stellar Development Foundation CEO Denelle Dixon and Coinbase CEO Alesia Haas (who is also chief financial officer of the Coinbase Global parent company) all testified. CoinDesk’s Nikhilesh De live blogged the hearing, and the full coverage can be found here.

Amid Cascarilla’s participation, stellar (XLM) prices rose by roughly 6% on Wednesday. The performance of XLM tokens hasn’t been impressive on a relative basis, up just about 98.6% over the past year versus ether’s 691% increase during the same time period.

Stocks rose on Wednesday again as fears about the Omicron coronavirus continued to fade. Investors’ rising appetite for risk assets came after Pfizer and BioNTech announced that initial lab studies showed a third dose of their COVID-19 vaccine could “neutralize” the new variant. That could potentially benefit the crypto market, as it usually follows the stock market.

Technician’s take

Bitcoin (BTC) continues to stabilize at about $50,000 after a near 20% sell-off over the past weekend.

For now, the cryptocurrency remains above $46,000 support, which could stabilize short-term pullbacks. Buyers will need to break above $55,000 resistance to yield further upside targets.

Momentum signals are improving on intraday charts, which suggests buyers could remain active at around current support levels. And the relative strength index (RSI) on the daily chart is the most oversold since late September, which preceded a price rally.

Bitcoin is stuck in a short-term downtrend, defined by lower price highs over the past month. Price indicators, however, suggest selling pressure could slow heading into the Asia trading day. That means intraday trading volume could rise around the 100-period moving average (currently around $54,500) on the four-hour chart.

Important events

9:30 a.m. HGT/SGT (1:30 a.m. UTC): China consumer price index (Nov. YoY/MoM)

9:30 a.m. HGT/SGT (1:30 a.m. UTC): China producer price index (Nov. YoY)

2 p.m. HGT/SGT (6 a.m. UTC): Japan machine tool orders

3 p.m. HGT/SGT (7 a.m. UTC): Germany imports/exports (Oct. MoM)

“First Mover” hosts spoke with Kalin Metodiev, co-founder and managing partner at Nexo, as the fintech formed a partnership with Fidelity Digital Assets to expand institutional access to crypto. MoonPay co-founder and CEO Ivan Soto-Wright provided insights into its latest funding round that values the company at $3 billion. Crypto CEOs are testifying in front of lawmakers today. CoinDesk’s managing editor for global policy and regulation, Nikhilesh De, brought us the latest from the hearing. Plus, CoinDesk Chief Insights columnist David Z. Morris spoke with one of CoinDesk’s Most Influential winners, Strike CEO Jack Mallers.

Coindesk