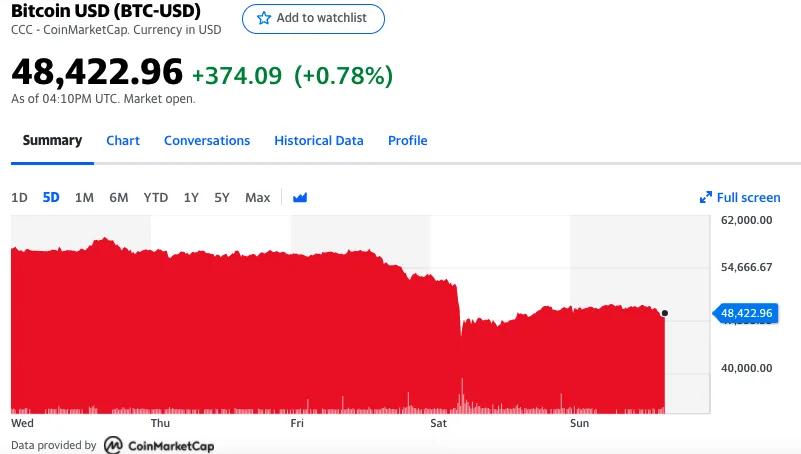

The grim weekend cryptocurrency drubbing that dragged Bitcoin (BTC) under $50,000 and ravaged other digital coins has decisively tempered the bullishness of investors — some of whom were predicting a run at $100,000 just weeks ago.

Fueled by uncertainty over the Federal Reserve inching toward tighter monetary policy in the face of surging inflation, and global fears over the new Omicron variant of COVID-19, the dramatic crash was super-charged by liquidations in the crypto derivatives market, market players say.

Only Friday, Bitcoin sat above $57,000 before the risk aversion hammering stocks spilled over into crypto world — dragging the premier digital coin down by as much as 20% on the day to below $43,000. On Sunday, the currency bounced by over 2% to trade around 49,000.

Bitcoin "has been the best-performing asset out of all asset classes 10 out of the past 12 years it's been trading,"Perianne Boring, president and founder of the Chamber of Digital Commerce, a blockchain advocacy group, told Yahoo Finance on Monday.

"To have anywhere from 30-40% volatility in any given month, that's normal for bitcoin. This is not a unique situation," Boring added.

According to estimates by Larry Cermak at The Block Research, nearly $5 billion in open interest was wiped out in as little as half an hour. That helped to shave cryptocurrency’s total market capitalization down to around $2.3 trillion, off sharply from last month’s record high above $2.6 trillion.

In some parts of the market, BTC’s price collapsed even lower, with some exchanges pricing it as low as $28,000 according to Jason Lau, chief operating officer of the cryptocurrency exchange Okcoin.

“As is usually the case, cascading liquidations in the derivative markets drove exaggerated moves,” Okcoin’s Lau explained.

Because fewer people typically trade on weekends, the crypto markets often deal with much lower levels of liquidity – providing even less of a buffer against nosedives. Lau and investors say thin market conditions fed the carnage in Saturday’s price action.

On Sunday, some cryptocurrencies recovered a bit of lost ground. Ether (ETH-USD) plunged by over 20% but clawed back some losses, currently floating around $4,100. Smaller blockchain units where liquidity is even lower, like Solana (SOL1-USD), are also nursing a 20% net correction.

Yet bucking the trend was Terra’s Luna (LUNA1-USD) – a stablecoin-pegged token that's seen the most significant crypto gains in the last several weeks. Up over 10% on the day, Luna flipped its initial slide into a weekend bull run that's logging back-to-back all time highs.

This weekend’s selloff is just the latest of several flash crashes this year that have sent some investors reeling, even as El Salvadorian President Nayib Bukele – whose country became the first sovereign government to embrace Bitcoin as legal tender – proclaimed that he “bought the dip.”

The “buy the dip” philosophy is spurred by Bitcoin investors’ belief that no matter how sharp a drop, the asset will continue to rise over the long term, thanks to free spending governments and loose monetary policy sparking inflation.

“Fundamentally, the continuation of monetary expansion and declining purchasing power is not disappearing and will only drive more interest into scarce assets like bitcoin,” Okcoin’s Lau told Yahoo Finance.

But short-term sentiment around the asset has clearly shifted. Bitcoin has experienced “violent swings” of 20 to 30% in previous bull runs before reaching its peak, according to Anto Paroian, chief operating officer of ARK36, a crypto hedge fund.

Yet this time around, BTC’s 20-week moving average – a key bull market indicator – “has now been decisively breached,” Paroian told Yahoo Finance, warning that “the outlook is currently bearish in the short to medium term” as some investors look to shed their riskier assets.

With the Fed seemingly more concerned about inflation and Omnicron fears widening, investors are walking back hopes for Bitcoin hitting $100,000 – a “much anticipated milestone,” according to Baxter Hines, chief investment officer of the Texas-based Honeycomb Digital Investments.

Bitcoin’s rally has been fueled in part by borrowed money or leveraged positions on derivatives exchanges, with some using the digital coin as margin collateral. As such, a heavily-leveraged market is vulnerable to shakeouts that exacerbate violent moves.

Over the last quarter, money locked in decentralized finance protocols surpassed $100 billion, according to DeFi Pulse, a fourfold surge since the start of the year.

And when crypto prices “went South” on Friday, so did the collateral-backing loans made to derivatives traders, Hines pointed out – ramping up margin calls that force traders to liquidate positions to cover losses, as well as volatility.

With open interest already down sharply, the drop could get even worse when Monday’s regular session begins. That’s because the Chicago Mercantile Exchange (CME), which is accounting for an increasing level of open interest volume on BTC futures, doesn't operate on Saturdays.

“It'll be interesting to see what happens when Monday comes around,” Lau added.

Finance.Yahoo