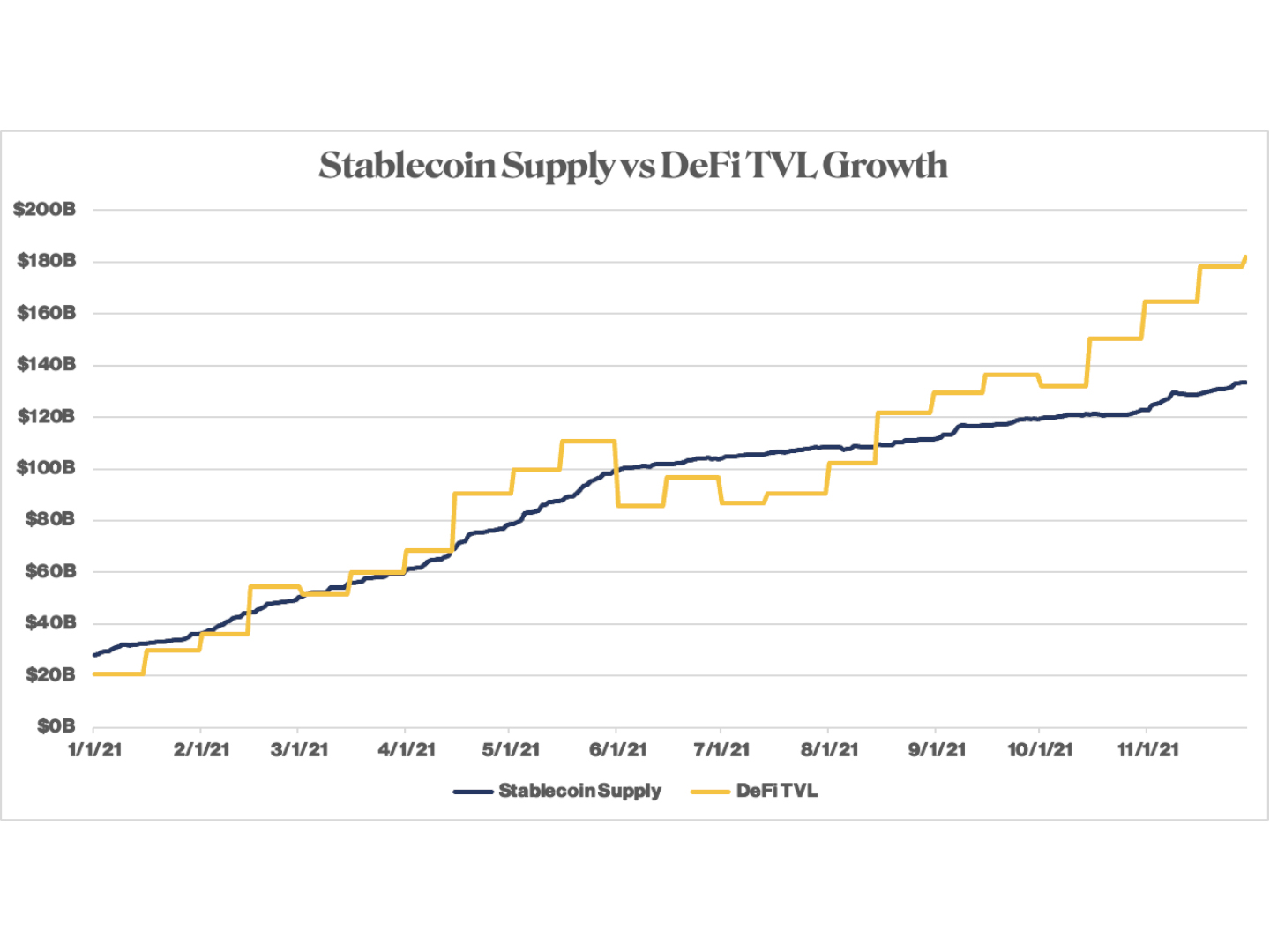

As innovation on top of Ethereum continues to connect DeFi with the outside world, stablecoin growth appears to be a strong measure of adoption.

Interest in the cryptocurrency markets came roaring back this fall, with bitcoin and ether both breaking their previous all-time highs just weeks ago. However, shortly after the breakout things turned south, and the market took nearly a 25% dip.

While many investors and traders were calling for an end to the bull market, the stablecoin printer continued to pump new capital into every corner of crypto. Several billion-dollar funds were announced and institutional investors were taking part, arguably for the first time in the short history of the asset class.

The growth of stablecoin supply is likely correlated to decentralized finance (DeFi) total value locked (TVL) for two reasons:

New capital is adding buy pressure to crypto assets, artificially boosting the dollar measure of TVL;

New capital is looking to be deployed throughout DeFi to earn yield on trading fees, lending yield and on-chain derivatives.

While it could be argued that new market entrants are coming to extract value from the market and leave, it appears that this must be a fringe case. Since the beginning of 2020, stablecoin supply has been almost “up only,” hinting that users may sell into stablecoins, but they are not leaving the industry.

The largest bear-case scenario boils down to the fact that most successful DeFi applications are currently used for further speculating on the future of crypto and not solving any real-world problems. However, promising use cases continue to arise, with prediction markets, gaming, 24/7 forex trading and undercollateralized loans all coming to fruition.

Regardless of short-term price action, the adoption of stablecoins and DeFi applications by funds, institutions and individuals is a positive for the industry. Innovation on top of Ethereum will continue to connect DeFi with the outside world, and stablecoin growth should continue to be a strong measure of adoption.

Pulse check

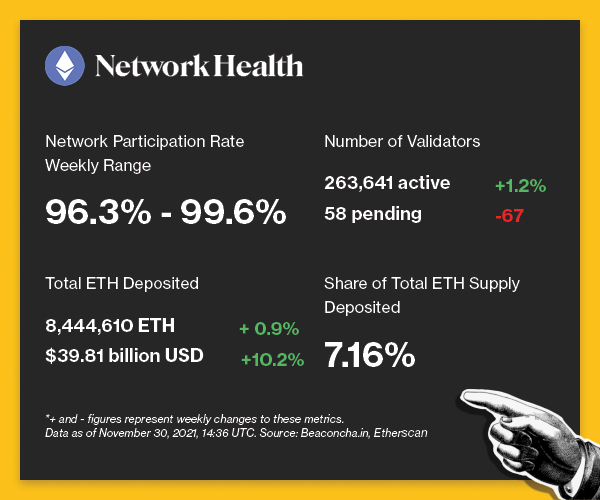

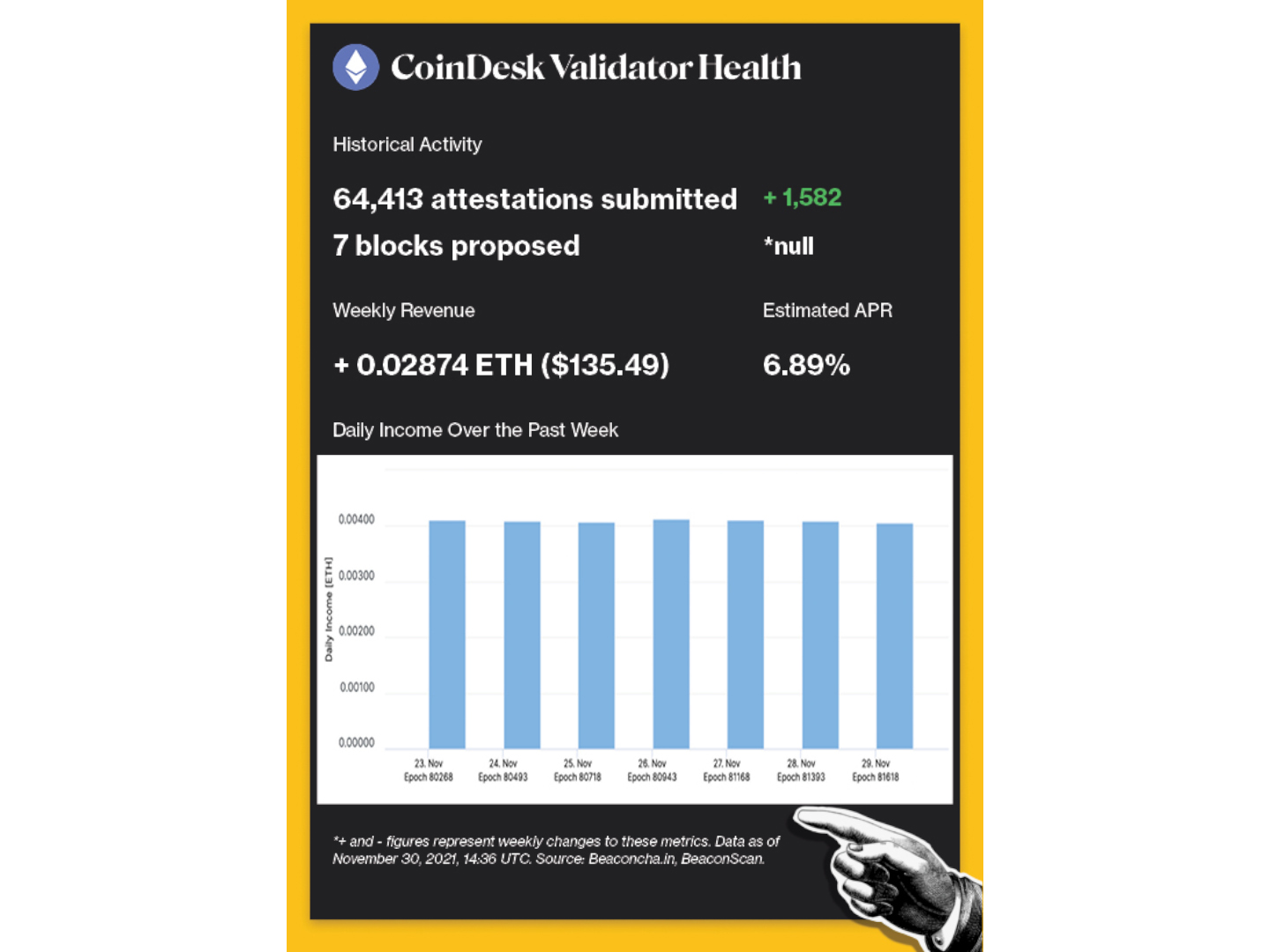

The following is an overview of network activity on the Ethereum 2.0 Beacon Chain over the past week. For more information about the metrics featured in this section, check out our 101 explainer on Eth 2.0 metrics.

Coindesk