Money is a popular topic. It always has been. This is because money represents the very things that we care about, the things we cherish and fundamentally value.

And what we value is where we put our heart, mind, and hands; these values drive us to get up every morning and when we do we willingly trade our most valuable asset — our precious and limited time — in exchange for those things.

For some of us it is the only thing that matters while for others it is simply a means to an end. For most of us it’s a bit of both of these extremes; we know that we need money to provide for our basic needs — food, water, and shelter — and we also have other desires as well that seem, in the moment, just as important (if not more so).

Consequently, it matters how we spend our time and that necessarily means that we must seriously consider how we make money, build wealth, and save for our individual and collective future.

But we aren’t always rational, are we?

Something isn’t quite right.

I’m constantly reminded of Adam Smith, the father of modern economics, who posited the Water / Diamond Paradox when he saw how irrational humans can truly be.

Obviously, without water, humans would die and yet people will spend fortunes on things (“diamonds”) that are unessential to human life. Smith determined that “value in use” was separated from “value of exchange” and couldn’t quite reconcile these things in his own mind and thesis. And it wasn’t until a few hundred years later that three economists — William Stanley Jevons, Carl Menger, and Leon Walras — were able to answer this paradox through a more scientific approach that appreciated real human behavior in light of economic decision making.

Whew, thank God.

But here’s the TL;DR and the point of this post: Building financial systems and wealth (or “getting rich”) is everyone’s game but the amounts differ just as widely as our motives; we can all agree that money is important but how we think about value, how we spend our time, and even how we define and discern our purpose is still ripe for personal discovery and further examination.

It feels immature and somewhat patronizing to say this but I’ll say it anyway: The mature adult cares just enough about their finances to ensure an anxiety-free lifestyle and is willing to “put in the work” to discover, design, and then deploy better financial systems when they are presented with them.

Changing your mind is a super-power, after all.

Admit it… we can obsess over this stuff.

You see, this is my story. This is your story.

This is our story because, like you, I’ve spent most of my life worrying about my finances and my financial situation; I’ve been anxious about how I’m going to afford what I need and what I want and I’ve had some really scary moments where I wasn’t sure how I was going to provide for my growing family and the ever-expanding responsibilities of being a husband and father of 3.

Those were some of the toughest (and darkest) seasons of my life; I never, ever, want to go back.

As an obvious consequence I’ve tried many different financial strategies / investments — as many as I could reasonable experiment with — and even types of work and industry (just look at my insane CV!!) so I could accelerate the growth of my bank account (e.g. wealth and savings) at a rate faster than economic inflation and the depreciation of the currency that was sitting in said bank account(s).

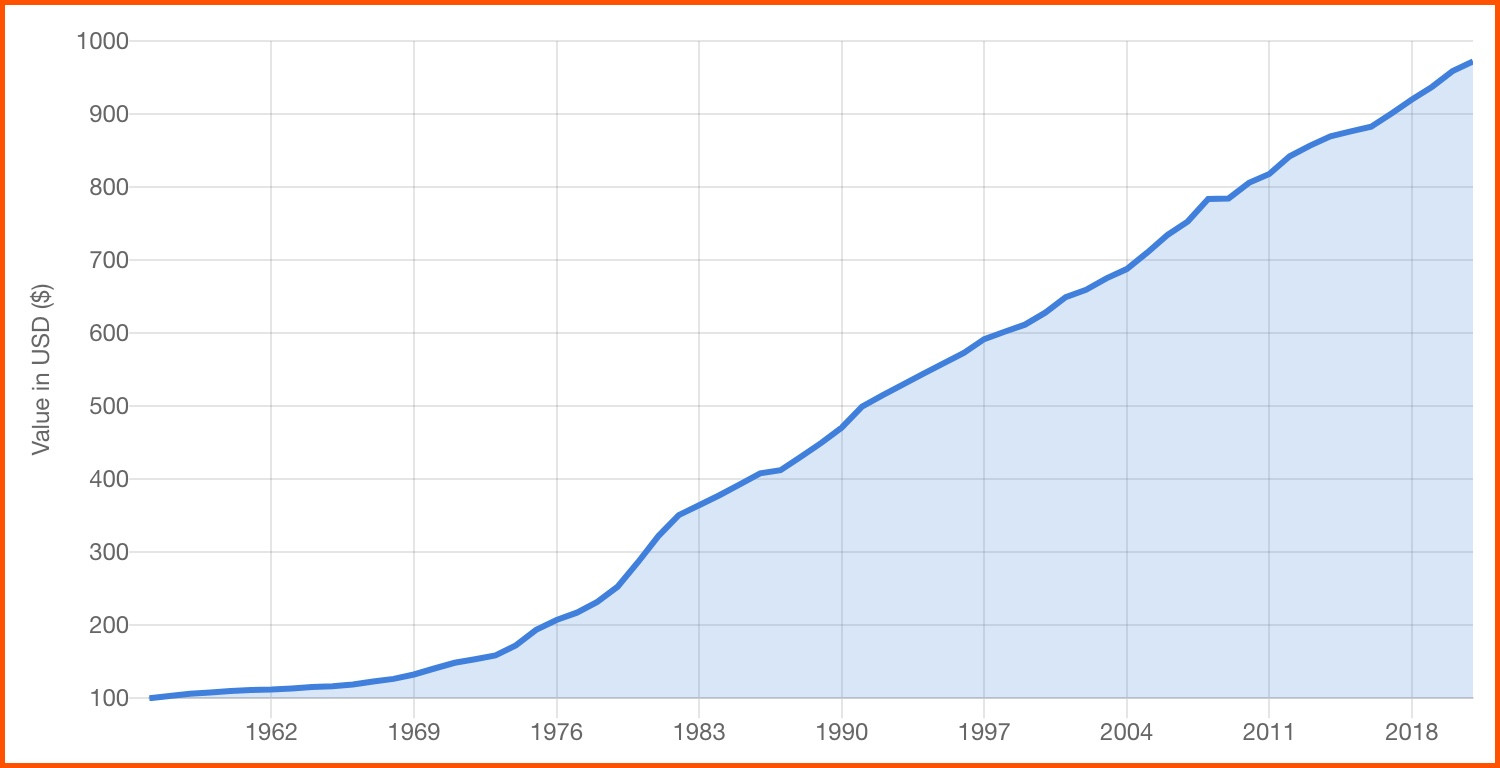

Never, ever forget: The United States Dollar has systematically lost its value every year since inception and charts like this feel “good” until you realize your interpretation of graphs like these are wrong:

It all looks so positive…

This graph above shows that in 1956 your $100 was worth $100 and you could buy $100 worth of goods and services. In 1956 a gallon of milk was ~$0.25 cents so you could buy effectively 400 gallons of milk.

Now, in 2021, for the exact same amount of goods / services you’d have to bring nearly $1,000 to the table! And what did you pay for a gallon of milk last week? I’ll bet you $1,000 dollars of BTC that you didn’t pay 25-cents! More than likely you paid something close to 10X, like $4.00 USD or equivalent.

See? Inflation. It is fucking all of us. Equally. Universally. It’s bad. Really, really bad. Even when you think you’re earning more it still fucks you.

This is sad, tragic, and disgusting. It honestly makes me sick to my stomach and it also causes a ton of fear an anxiety within my mind, body, and spirit. Why? Because I work hard for what I earn — just like you — and when I put some of it away for the future I know that I’m making a fundamentally bad investment because I know that it is also losing value, daily, and is literally rotting away in a bank account.

🤮

It makes me feel out-of-control and it’s only gotten worse in the last year. I call it a financial pandemic, which may feel extreme, but I don’t think I’m being extreme when I see and experience a system that legally robs me every single day that I did not want (or vote for) and that ultimately hurts my family and our future.

And if I sit on this topic for too long I get depressed. Go figure.

Consequently I’ve spent my entire adult life experimenting with as many investment “strategies” that I could find, diligently test-driving each one and working on different time preferences / horizons to figure out which one could work for us the best.

And when I finally understood the power that is bitcoin (I didn’t get it immediately, mind you) and when I began to experience it for myself I realized that I had landed on a solution that actually works.

🚀 — I’ll get straight to it: Bitcoin has changed my life. Full stop. In every single way

The more obvious (and boring) changes have been financial as we have much more money than we did before we started DCA’ing BTC but the more important changes have been emotional, psychological, and even spiritual (but that’s if you want to go with me all the way down the “rabbit hole”).

BTC has changed everything. EVERYTHING. EVERRRRYYYYTTTTHHHIINNNG.

Give this a serious listen… digest it… then let’s talk about it.

And when you encounter something so significant (like the Gospel or the Metaverse or something life-changing like that) you just have to tell people. I mean, wouldn’t you?

Here are some of the more important numbers / math that should be an encouragement, inspiration, and lesson for all of us…

… if you had invested $100 every week for 6 years (from May 23, 2015 to May 23, 2021) it would be a total investment of ~$31,400 which works out to be approximately 27 BTC. And, at a value of ~$33,000 per coin this equates to a total value of ~$900k — a whopping 2,600% growth over principle and a ton of wonderful profit.

💹 — A Simple Recap! Using DCA on bitcoin at $100 per week for a total investment size of ~$30k over 6 years would have given you a tidy profit of ~$870,000.00!

This transparent, never-changing math is fucking glorious! This isn’t “fake” digital coin money created ex-nihilo; this is real, tangible, fungible value that I’ve been able to use for real things, like food, clothing, and shelter.

You know, really-real stuff like that.

The strategy? As I mentioned in the video it’s crazy-stupid simple: Dollar Cost Averaging. This is a simple investment procedure where you invest the same amount of money at the same time, regardless of the price (e.g. $100 USD into bitcoin every Friday @ 5:00pm EST).

The benefits? Let me count the ways! The consequences of this type of investment strategy and methodology are as profound as they are simple: Executing DCA reduces the overall impact of price volatility of your target asset via your consistent (and sober) investment which mathematically-reduces risk over time.

Masks work to stop the spread of disease. Why? Science. Just like Bitcoin. This is not a political statement.

What’s so great is that you don’t have to be a “genius” to get bitcoin; in fact, you don’t have to understand much of anything that I’ve written (although I’ve tried to keep it simple) and you can still win by investing in BTC.

This is also why the “elites” get so easily offended because it showcases their fraudulent financial strategies as nothing more than a poorly-manicured public circus. It’s also why I have friends all over the world who have “zero” financial background or education but who are living anxious-free lives with bitcoin as their saving system of choice.

So offensive… so legit.

🛑 — Bonus from the Pros: The longer your time preference the greater control you wield and the more risk reductions you accrue. This is because you statistically and systematically remove “poorly timed” investments — usually in larger, lump sums — based on emotion, public opinion (i.e. hysteria), or worse.

Hey, I would know! As I’ve said I’ve tried everything because my family and our future depends on it. I desperately want to get ahead of all the financial unrest, anxiety, and turmoil that the public (and fiscally-propped-up) markets present to me.

Turns out there are vastly better options; turns out that you simply can’t control price-action but you can control how you feel about it through a responsible, sophisticated, and proven financial strategies like Dollar Cost Averaging. It is both an investment discipline and practice which trains you to detach your emotions from price.

The problem is that it’s hella boring and requires you to be uber patient and most of us hate to be bored and the vast majority of us are impatient as all get out. This is why bitcoin is generally unapproachable by most because it’s so counter to our natural inclinations; it’s just counter-intuitive as fuck.

And this is why I am begging you, especially if you’ve known me for some time (and even more so if you’re a friend or family member), to seriously consider what I’m sharing with you today and to listen to what I’ve shared and to look at what bitcoin has done for my life and for my family.

I’m not anti-banks; I’m anti-fear and control.

💴 — Bitcoin has changed my life. This is not hyperbole. I am living this new reality and it’s better this way. It’s available to you, too.

Bitcoin (and my stupidly-simply, offensive-to-central-banks investment strategy) has allowed me and my family to live with less anxiety about our finances and our future.

This is the dream! Other benefits include being able to spend more time on creative work (my art!) and philanthropy (giving back!) which are all intrinsic benefits and consequences of a more natural monetary system and policy…

… but that’s for another, longer blog post.

Here’s the thing: I love you all, my readers and my community and I take serious the responsibility that I have to share all that I know with all of you. This includes how I do my work, how I live my life, the systems that guide it, and the outcomes that result from experimenting broadly and taking a scientific approach to life.

I’m having more fun doing what I love and I’m getting to spend more time with the folks that I love and who love the stuff that I love… I mean, that’s what this life is all about.

🤔 — So, how does one “get rich,” really?

Well, for me it’s not about the size of my bank account or the liquid value of aggregate assets; rather, I’ve “gotten rich” (or built a system of wealth generation) via 3 distinct principles that are backed by simple behaviors:

- Longer-time horizons (i.e. longer time preferences) are vastly superior than shorter time preferences. My family makes long-term financial plans and then we build systems that we can (literally) afford that will make those plans come true. Investing $100 every week for 10+ years is something that we can do but you could start with $10.

- Give and save more than you spend. We teach our kids a simple “give, save, spend” system (in that order) and then we have a more “grown-up” version too.

- I talk openly, honestly, and consistently about money generation, production, and even topics like inheritance (death / dying) thus making them less taboo in my own context which increases financial literacy for my children, family, and friends. We are all better for it!

There are many ways to “get rich” but many of them require you to compromise your morals, integrity, or even your agency and liberty to get there. Bitcoin has provided a viable, useful, and financially-attractive alternative toward personal and financial freedom that doesn’t require a Ph.D in economics or finance to get started.

All you need are a few good friends (a community!) that is willing to talk about these things in an honest and transparent way. I mean, that’s always the best way, right?

Let me be that friend for you.

How can I get you into bitcoin? What more can I share with you? How can I help you get into this magic (but real!) unicorn money? I’d be honored to help!

L(° O °L)

The bitcoin chat room is always open and I’m always around to answer your questions.

Oh, and by the way, the real test for any “bitcoiner” is also the same test to deem anything as worthy, authentic, and true: Do they walk the talk? Do they actually behave in a way that is aligned with their beliefs?

It’s the same with startups:

https://john.do/ultimate-test/

When you boil it all down it reduces to this: The reason you can believe me re: bitcoin is because my life is literally powered by it. I have my life (and my family’s life) as hard, incontrovertible evidence that bitcoin works. What I say is true because I’m living that reality and can provide the proof!

But you don’t have to believe me, of course. To infinity & bitcoin. Chat soon.

Part II: My Bitcoin-Powered Wealth System

Need more help? I’ve got my system (and numbers) here in this larger post:

https://john.do/wealth/

How the sausage gets made.

Enjoy!

Originally posted at https://john.do/ by John Saddington