The majority of South Korea’s cryptocurrency exchanges will likely shut down by next Friday, as operators race to meet stringent new rules from the country’s financial watchdog.

By Sept. 24, all exchanges operating in South Korea must obtain licenses from financial and Internet regulators. As of Monday, only 28 exchanges—out of the 63 operating in-country—had received certification from the Korea Internet and Security Agency (KISA), the first step to obtaining final approval from the Financial Services Commission (FSC). The remaining 35 exchanges are unlikely to be able to comply given the looming deadline, says the FSC.

The crypto industry worldwide has for many years “lobbied to have clear regulatory frameworks,” says Henri Arslanian, partner and crypto leader at consultancy PwC based in Hong Kong. Many crypto leaders welcome straightforward rules because “operating in gray areas makes running the business challenging, from fundraising to opening bank accounts,” Arslanian notes. “It’s not in the best interest of the public, either.”

Still, the rapid-fire closure of over half of South Korea’s crypto exchanges could pave an easy path for crypto monopolies to emerge, which some say could harm ordinary investors.

Survival of the fittest

South Korea’s crypto market first surged in late 2017, when Bitcoin trading skyrocketed in popularity among ordinary citizens of all ages who looked to cash in on the digital currency’s rising price. The country became the world’s third-largest trading market behind the U.S. and Japan at the time. The market has fluctuated since then, alongside the price of Bitcoin, but in the past 18 months, South Korea’s crypto market has experienced a resurgence aligned with the pandemic-fueled global boom in digital currencies. The Korean won now ranks third worldwide behind the U.S. dollar and the euro as the most commonly used currency for trading Bitcoin, says Coinhills data.

Young retail traders, facing rising real estate prices and stagnating salaries in a competitive job market, helped fuel South Korea’s crypto frenzy this time around. For young investors, the crypto market provided easy access to trading and the prospect of quick gains. Around 60% of South Korea’s new crypto investors are in their twenties and thirties, according to data released in August from Yoon Doo-hyeon, a member of the South Korea National Assembly’s Political Affairs Committee.

Seoul in recent months has cranked up its control of the country’s cryptocurrency industry to rein in illicit activities such as money laundering and tax evasion, and what regulators view as risky financial activity among young retail traders. In 2022, the government will also introduce a crypto capital gains tax; investors who make over $2,135 in trading profit will face a 20% tariff.

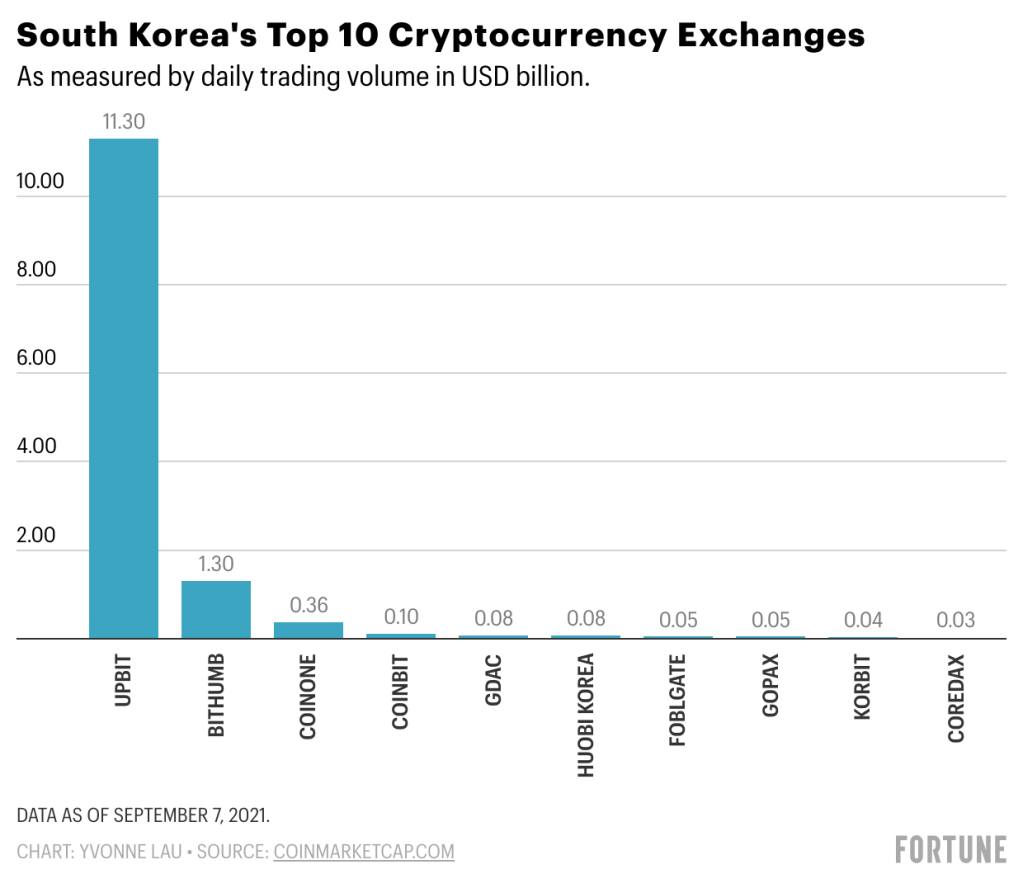

Last September, state authorities raided the offices of Bithumb and Coinbit, the second- and third-largest exchanges in the country by trading volume, over fraud allegations. Coinbit later told CoinDesk that its former employees, now facing fraud charges, carried out “wash trading” by creating fake user accounts that made trades to inflate the exchange’s trading volumes. After the September raids, South Korean police also investigated Bithumb’s former chairman Lee Jung-hoon and seized his company shares. Police have opened a second fraud investigation into Lee after a group of 14 investors filed another complaint in July, according to local media reports.

Regulators say crypto scams in South Korea are becoming bigger and more frequent, aided by the industry’s rapid growth. Crypto fraud reports increased 42% in 2020, regulators say, and several crypto exchanges in addition to Bithumb and Coinbit have been accused of fraud. In June, for instance, police arrested four executives of now-defunct exchange V Global on fraud charges; authorities say the case involves 52,000 victims and losses in excess of $1.9 billion.

In addition to the new rules, the government is setting up a new crypto bureau this month that will operate under the FSC to supervise the country’s digital assets. South Korea’s regulators aren’t alone in their clampdown on the crypto industry: Regulators worldwide from China to the U.S. are seeking tighter control for some of the same reasons; to stop financial crimes and improve investor protection.

Former FSC chairman Eun Sung-soo, who stepped down in August, has been an outspoken critic of the South Korean crypto industry. Eun said in April that cryptocurrencies “have no intrinsic value…[and] are not a real currency. I would advise people not to invest in cryptocurrencies. It’s too risky to trade [cryptocurrencies] considering their high price volatility.” Eun’s successor, Koh Seung-beom, holds the same hawkish stance toward the crypto industry; Koh in August rejected the idea of cryptocurrencies as a legitimate financial asset.

In March the FSC, under Eun’s direction, introduced new rules stipulating that domestic and foreign crypto exchanges must be vetted by the Financial Intelligence Unit (FIU) before their applications are passed on to the FSC. To win FSC approval, crypto platforms must require users to register using their real names and bank accounts. Platforms also need to meet anti–money laundering standards by having their information security systems certified by the government’s Internet watchdog.

The rules force the exchanges to partner with traditional banks, which have the final say in confirming the partnership. Banks bear the risk if the funds are used for financial crimes so they have been unwilling to partner with smaller exchanges that lack the resources to implement stringent anti–money laundering systems. On Friday, the sixth-largest exchange, Huobi Korea, announced that it had suspended Korean won trading owing to its inability to obtain a bank partnership.

Only four of South Korea’s platforms, Upbit, Bithumb, Coinone, and Korbit, have submitted their registrations to the FIU, meaning that they have secured both bank partnerships and certification from the Internet regulator.

Some say that the mass closure of exchanges penalizes ordinary investors. Most of South Korea’s alt-coins—cryptocurrencies other than Bitcoin—will be lost via exchange closures, jeopardizing $2.5 billion of investor assets, according to estimates from Kim Hyoung-joong, a professor and head of Korea University’s Cryptocurrency Research Center. The FSC urged investors to withdraw assets ahead of the Sept. 24 deadline, warning that those assets could be irretrievable if an exchange shuts down. The FSC didn’t reply to Fortune’s request for comment.

Last week, a group of small and midsize exchanges held a joint press conference saying that the rules will “allow for a lopsided monopoly to emerge.” Noh Woong-rae, a Democratic Party member of parliament, also warned that “if a monopoly market emerges, any exchange could list or delist coins, or raise transaction fees at will,” according to local media reports.

Others say that fears of exchange monopolies are overblown. The abundance of “overseas options for centralized exchanges, and the massive growth of decentralized exchanges shows that the options offered to traders are increasing, not decreasing,” says Justin d’Anethan, head of sales at Eqonex. Tightened rules mean that only the “less compliant and less prepared” platforms will be killed off, he says.

“These regulations legitimize the crypto space and clarify industry practices for the participants that can cope,” says d’Anethan. “Long-term, the regulator’s efforts will be positive for the industry.”

Fortune